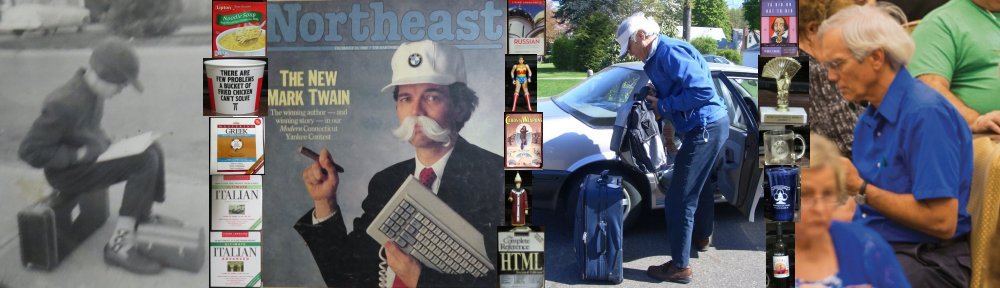

Michigan football and me. Continue reading

I undertook this entry to explain what it was like to be a die-hard fan of a football team for fifty-eight years. I supposed that this might be of passing interest to some people (outside of New England, where no one gives a fig about college football), but, in fact I undertook it mostly to see if I could figure out to my own satisfaction why I have cared so much about an institution with no intrinsic value. Furthermore, over the years it has changed so dramatically. The only constants were the huge stadium, the winged helmets, and the school colors—maize and blue (mostly blue).

Before attending U-M: When I was still in grade school (not before—my family did not have a television set) my dad and I often watched professional football games on our black and white television set. This was remarkable for two reasons: 1) my dad seldom watched anything on television; 2) it was one of the few things that we did together. I distinctly remember that a white football was used for night games. Also, until the rule was changed, a runner was not considered “down” until his forward progress was completely stopped.

My dad was a fan of the Chicago Bears. My recollection was that his favorite player was Ralph Guglielmi, but he never played for the Bears. I must be wrong. My favorite team was the Cleveland Browns. In the early days my favorite player was #14,Otto Graham. Later, of course, I lionized the incomparable #32, Jim Brown.

Before I went to Rockhurst my dad also took me to one game in Atchison, KS. It involved my dad’s Alma Mater, Maur Hill. I don’t remember the opponent or result. However, Maur Hill was 2-6 in both 1960 and 1961, and so they probably lost.

The Dallas Texans moved to Kansas City in 1963, my sophomore year at Rockhurst, and were rechristened the Chiefs. Through his company, Business Men’s Assurance (BMA), my dad had two season tickets. He went to all the home games, and sometimes he brought me with him to the games at Municipal Stadium. I became a fan of Lenny Dawson1, Curtis McClinton2, Fred Arbanas3, the one-eyed tight end, and the rest of the players. I remained a big fan of the Chiefs while I was in the army and for a decade or so after that.

While I was in High School I attended every football home game. So did all of my friends and most of the other guys. My attitude was really more of a “be true to your school” thing than an appreciation of the game at the high school level. In fact, we all attended all of the basketball games as well. The guys at Rockhurst were proud that they were able to go to one of the very best schools in the area, and they supported all of the teams.

Undergrad at U-M:While I lived in Kansas City I did not follow college football very closely. Only three major colleges in Kansas and Missouri had football teams, and one of those—Kansas State—was perennially a doormat. I knew very little about Michigan football. I knew about the intense rivalry between Ohio State and Michigan. I had heard the song, “We don’t give a damn for the whole state of Michigan.” I had read about a few Michigan greats such as Tom Harmon and Germany Schulz. I knew that Michigan had the largest stadium in the country and usually won the Little Brown Jug. Woody Hayes (but not his counterpart Bump Elliott) was already famous.

However, it was not until I actually started living at U-M that I came to appreciate the importance of football at the university. Cazzie Russell had led the Wolverines to three consecutive Big Ten titles and to final four appearances in 1964 and 1965. Nevertheless, in the fall of 1966 when I arrived at my dorm absolutely no one talked about basketball even though the previous year’s football team had been a horrendous disappointment. The 1964 team had won the Big Ten and clobbered Oregon in the Rose Bowl. The 1965 team finished only 4-6 despite outscoring the opponents 185-161. Nevertheless, like nearly everyone else in Allen Rumsey House, I purchased season tickets in the student section of Michigan Stadium (no one ever called it The Big House) for a very low price and never gave a thought to going to basketball games.

I followed the marching band up

to the stadium for almost every home football game4 during the four football season in which I lived in the dorm. I have recounted in some detail those experiences in the 1966 season here. The last two games of my senior year were ones for the ages. On November 27, 1969, Ohio State was 8-0 and widely considered the best collegiate team of all time. They were riding a twenty-two game winning streak.. Michigan was 7-2, but one of its losses was out of the conference. Since this was the last game of the season, if U-M won, they would be tied with OSU for the the Big Ten championship. The league’s rules dictated that if there was a tie, U-M would go to the Rose Bowl because OSU had been there more recently. Michigan, a huge underdog, won the game 24-12. Wikipedia devoted a very long entry to this historic game. It is posted here.

I knew two of the stars of that game fairly well. They were both sophomores who had spent their freshman year living on the second floor of A-R. At the time I was the president of the house and had some interactions with both Thom Darden, a defensive back who was an All-Pro with the Cleveland Browns, and Bill5 Taylor, who scored the most famous touchdown in that game.

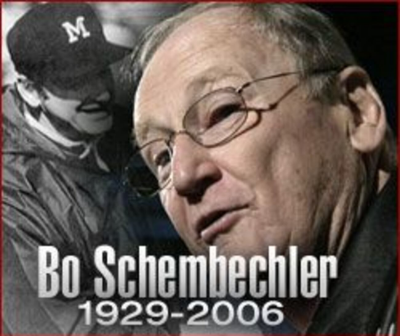

Michigan had hired a new coach, Bo Schembechler, for the 1969 season. He had a heart attack just before the Rose Bowl6, and so he was unable to coach. The team lost to the University of Southern California 10-3. In retrospect it is hard to believe that one of the most famous Michigan teams of all time did not score a touchdown in its last six quarter.

1970-1973: During the next four years it was somewhat difficult for me to follow the team too closely. In 1970 I was at my parent’s house in Leawood, KS, for the first three games, all of which were won by the Wolverines. For the remaining games I was at Fort Polk, LA (introduced here), for basic training. I learned the scores of the games, but there was no television available, and so I missed the second game of the “Ten Year War” between Schembechler’s troops and those of Woody Hayes. OSU won in Columbus 20-9. The two teams again tied for the Big 10 title, but OSU went to the Rose Bowl because of the “no repeat” rule. In those days Big 10 teams were not allowed to participate in other bowls.

In 1971 I was in the army at Sandia Base, NM (introduced here). The barracks had only one television, and none of the soldiers could afford to purchase one for their rooms. Michigan was 10-0 going into the OSU game in Ann Arbor, where they won a squeaker 10-7. I am pretty sure that I watched that one in the MP Company’s Rec Room. That team lost to Stanford in the Rose Bowl 13-12. Michigan was heavily favored and held the lead, but the team was done in by a fake punt by Stanford on a fourth and ten and a last second field goal. I must have watched that game in Leawood. A few days later I flew to upstate New York to finish my military career at Seneca Army Depot (described here).

In 1972 I was working as an actuarial student at the Hartford Life Insurance Company (introduced here). I watched the team on television whenever they appeared. I remember going to Jan Pollnow’s house for one of the regular-season games. I do not remember which one it was, but it was definitely not the season-ender (better known as The Game) at Ohio State. I am certain of that because Michigan won all of its first ten games, but they lost that one 14-11. This was a heart-breaker. Michigan had a first down at the OSU one-yard line and could not punch it in. The two teams tied for the conference championship, but OSU went to Pasadena, and U-M stayed home.

In 1973 I was still at the Hartford. Once again the Wolverines won their first ten games. The Big Ten by then was known as the Big Two and the Little Eight. “The Game” was held in Ann Arbor. At the end of the third quarter the score was 10-0 in favor of OSU, but U-M tied it with a touchdown and a field goal. I am pretty sure that I watched that sister-kisser by myself in my apartment in East Hartford. I had a Zenith color portable with rabbit ears. The reception from the two ABC stations (New Haven and Springfield) was not great.

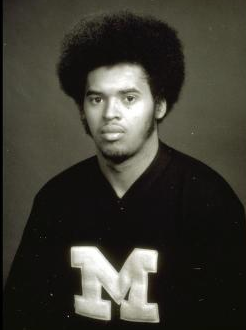

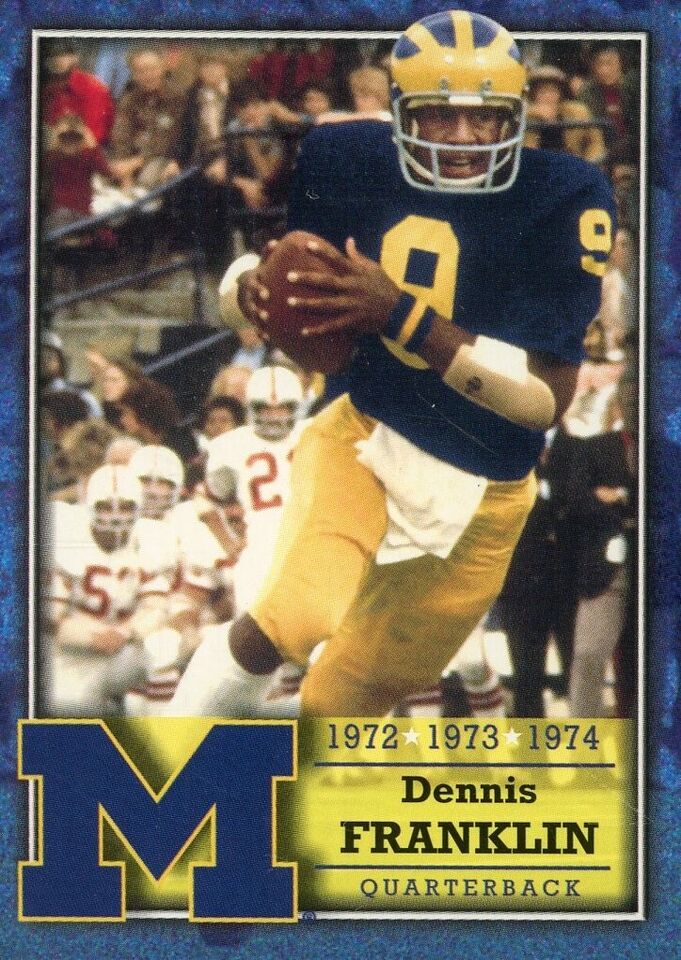

U-M’s quarterback, Dennis Franklin8, broke his collarbone in the fourth quarter. This was a decisive factor in the vote that sent the Buckeyes back to California. In two years U-M had lost only one game, but it did not get to go to a bowl game.

By this time Bo Schembechler had installed an option offense that emphasized running. For quite a few years U-M’s quarterbacks were better known for running and blocking than for throwing the pigskin.

Back in Ann Arbor for 1974-1976: In 1974 Sue and I moved to Plymouth, MI, and I enrolled at U-M as a graduate student in the speech department. I bought a season ticket in the student section. A few details about my personal involvement with the team during those years have been posted here.

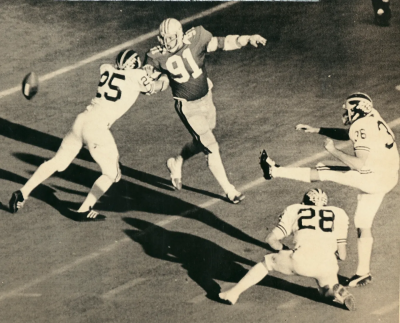

A little more should be written about the 1974 season. The Wolverines breezed through the first ten games. They even had a 10-3 lead at halftime of The Game. However, OSU kicked three field goals and Mike Lantry9, who had earlier kicked a 37-yard field goal, pushed a shorter one very slightly to the left as time ran out. The miss cost U-M the conference championship and a berth in the the Rose Bowl.

Dennis Franklin, who lost only two games in his entire career as starting quarterback at U-M, never got to play in a Rose Bowl, or any other bowl for that matter. That was simply a travesty.

Detroit 1976-1979: For the next three football seasons Sue and I lived and worked in Detroit. I watched every game that was shown on television, but my memories are not too distinct.

The 1976 team lost a conference game at Purdue when the kicker, Bob Wood, missed an attempted 37-yard field goal at the end of the game. It was the first conference loss to one of the Little Eight since my senior year seven years earlier.

However, this team pummeled Ohio State in Columbus two weeks later to win the conference championship and qualify for the Rose Bowl. They lost that game to USC (whom else?).

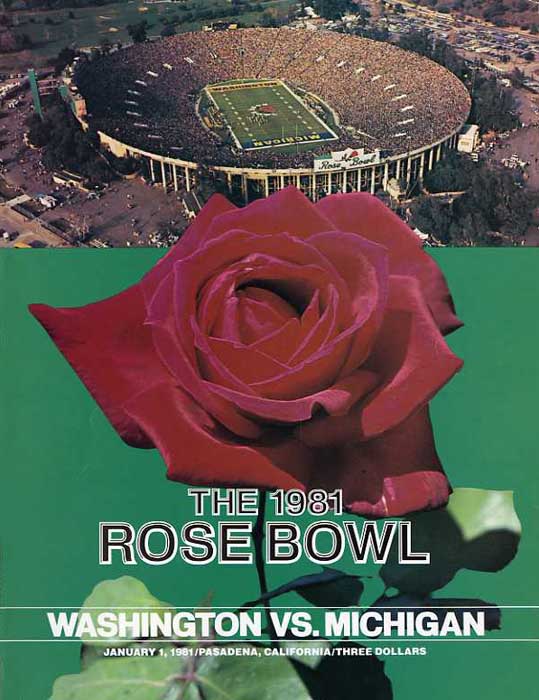

The story the next year was eerily similar. The Wolverines were shut out in the Little Brown Jug game, but they defeated Ohio State in Ann Arbor. They then lost to Washington in the Rose Bowl 27-20.

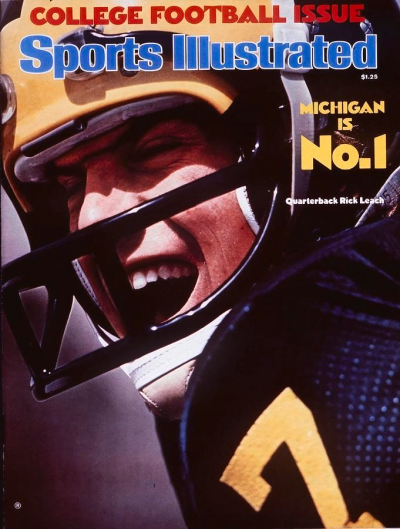

It sounds like a broken record, but the 1978 team led by Rick Leach10, Harlan Huckleby11, and a very stout defense, somehow lost to Michigan State before beating the Buckeyes again in the last game of the Ten Year War. USC then defeated the Wolverines in the Rose Bowl again thanks to a “Phantom Touchdown” awarded to Charles White12 by a Big 10 ref.

I have two very vivid memory of this period of Michigan football. I remember that I was on a debate trip for Wayne State. For some reason one Saturday afternoon I was absolved of the responsibility of judging for one round. I found a television set and watched Michigan beat up on one of the Little Eight.

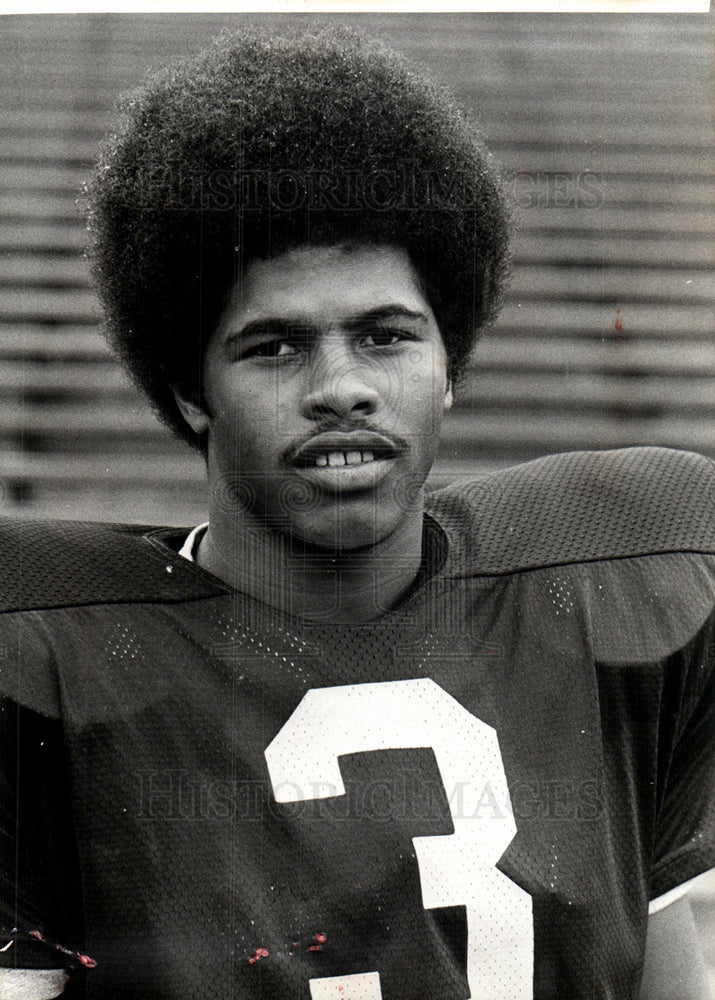

The other memory, of course, was the dramatic touchdown pass from John Wangler to freshman Anthony Carter on the last play of the Indiana game in 1979. The game, which was crucial for Michigan’s title hopes, was not televised. But the film was shown on all the highlight shows.

It was a period of frustration. It appeared that Bo’s coaching style could easily produce very good teams. They were always in the top ten and often the top five/. However, they were never good enough to win the last game of the year. Nevertheless the players were heroes to me and to all of the other die-hard fans.

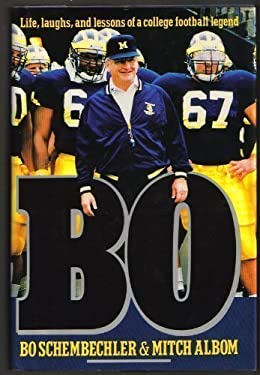

I later read Bo Schembechler’s autobiography, Bo, co-written by Mitch Albom. In its pages he speculated that he might have driven the guys too hard on their trips to Pasadena. They did little besides practice. Most Michigan fans just thought that the team needed a passing game.

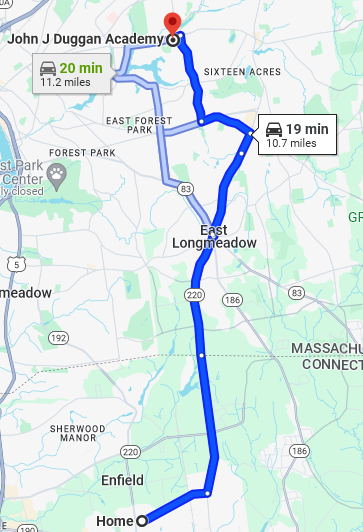

Michigan Replay: Most U-M football games were not telecast in the Detroit area while we lived there. However, every Sunday evening Bo Schembechler appeared on a half-hour interview show with Jim Brandstatter13, who had been an offensive tackle on some of his very early teams. Sue and I watched these programs every week. When we moved to Enfield, one of the few things that we missed about the Motor City was watching Michigan Replay on channel 4.

I recently discovered that the Michigan Replay shows have been archived by the university and posted on the Internet here. I recently watched the show about the 1980 version of The Game in which neither side scored a touchdown. The first thing that I noticed was that Brandstatter just dwarfed Schembechler, who was himself a lineman in college. The second thing that caught my eye was Bo’s outfit. He was decked out in plaid pants and a grey sports jacket with a Rose Bowl pin. It was 1980, but Bo;s wardrobe was still in the seventies. I wondered if his wife saw this outfit before he left the house.

On the show Bo was charming and gracious. He always credited the players. What was so attractive about his approach on the show was how clear it was that everyone on the team gave 100 percent, and Bo loved them for it even when they failed. When Brandstatter heaped praise on the team’s defense, Bo insisted that the offense, which did not score a touchdown, did its part by running twice as many plays as the Buckeyes. His slogan—”Those who stay will be champions”—never rang truer.

Bo v. the world as seen from Enfield 1980-1989: The Wolverines finally found a passing game, or rather a receiving game, in #1, Anthony Carter14, who was by almost any measure the most amazing player in the history of college football. He was named a consensus first-team All-American three years running. During those three years Michigan was definitely a running team. In the first two Butch Woolfolk15 rushed for more than 1,000 yards. In 1981 he set the single-season U-M record with a total of 1,459 yards.

Nevertheless, the “go to guy” was Carter. He was always the first read on a pass attempt and the last read on most. The two quarterbacks who passed to him, John Wangler16 and Steve Smith17, are remembered mostly as footnotes in tales of Carter’s heroics.

The 1980 season was the most memorable one for me. Bo’s coaching staff had been depleted in the off-season. He had to hire many new coaches, including Gary Moeller, Lloyd Carr, and Jack Harbaugh17. The team had a very shaky start. It barely beat Northwestern in the opener and the lost two non-conference games. The fans were dejected, but the team—especially the defense—seemed to get better with each game. The three games before The Game were all shutouts, and the Wolverines racked up 86 point. The 9-3 win in Columbus was ugly, but the victory over Washington in the Rose Bowl was absolutely beautiful.

I have several vivid memories of the period. Most of them are disappointments. I can picture in my mind Cris Carter18 making a fabulous catch for a touchdown. My recollection is that it won the game for the Buckeyes, but this was not the case. Jim Harbaugh, my favorite Wolverine of all time, rewrite the record book in that game and threw a 77-yard touchdown pass shortly after Carter’s reception had brought the Buckeyes back to within a field goal.

The 1986 team fumbled away the Little Brown Jug that had been on display in the Michigan Union since 1977 and also lost decisively in the Rose Bowl. I do not remember either of those. I do remember that Jim Harbaugh guaranteed that U-M would beat OSU. They did, but only because of a missed field goal. I remember many field goals missed at crucial times, but this was the only one by an opponent that I can recall.

Michigan won the jug back in 1987, but that team won only seven other games. They did beat Alabama in the Hall of Fame Bowl.

Bo’s penultimate team might have been his best job as a coach. Without any great stars it lost its first two games and tied Iowa at Kinnick Stadium. It then won four straight decisively, edged Ohio State in Columbus, and then won the Rose Bowl by upsetting Southern Cal 22-14.

The first game of Bo’s last year was the worst. Rocket Ismail zoomed for two touchdowns on kick returns, and #1 Notre Dame defeated #2 U-M in Ann Arbor but won the remainder of its regular-season games. In the Rose Bowl the Wolverines lost to USC by a touchdown. Bo was incensed by a holding call on a fake punt that had gained twenty-four yards. After the game he resigned as head coach and took a job as president of the Detroit Tigers. He was fired from that job in 1992.

Bo had had heart problems for a long time before he died in 2006. His legacy was smudged by his son Matt’s claim that Bo knew about sexual shenanigans by long-time university doctor Robert Anderson.

Gary Moeller years 1990-94: I think that it was during Moeller’s five-year tenure at U-M that I stopped watching U-M games. His first team lost a close game to Notre Dame and two regular-season games. However, they closed out the season with five wins (tied for first in the Big 10) and handily defeated Ole Miss in the Gator Bowl. The team had developed a passing attack with Elvis Grbac19 and Desmond Howard20.

The next year the team lost to Florida State, but won its other ten regular-season games. The highlight was a completely horizontal 25-yard touchdown reception by Heisman-winner Howard on a 4th down against Notre Dame. However, the Wolverines were humiliated in the Rose Bowl by Washington.

The team had three ties but no losses in Grbac’s last year. It went to the Rose Bowl again and this time defeated Washington. Tyrone Wheatley was the star

Todd Collins took over at quarterback in 1993. The team lost four regular-season games, but they closed out the season with a 28-0 mauling of OSU and and equally decisive bowl victory over NC State.

1994 was the last year in which I watched Michigan football live. The disastrous game at home against Colorado was followed by losses to Penn State, Wisconsin, and OSU.

I remember storming out of the house at the end of the OSU game. I went for a long walk, and I was still upset when I returned. The team’s victory over Colorado State in the bowl game did little to mollify me. The stress of these games was becoming too much for me.

Gary Moeller was allowed to resign after being arrested in May of 1995 for drunk and disorderly conduct at Excalibur, a restaurant in Detroit. He served as an assistant coach in the NFL until 2002. He died in 2022.

Lloyd Carr’s years 1995-2007: Lloyd Carr was named interim head coach after Moeller’s untimely exit. It was made official after the team won eight out of the first ten games. I expected U-M to lose the finale against #2 OSU, and I did not get to see the 31-23 upset in which Tim Biakabutuka rushed for an astounding 313 yards. That team ended the season at the Alamo Bowl, where lost to Texas A&M. The 1996 team also beat OSU and lost its bowl game.

During Carr’s thirteen years as U-M’s football coach I was extremely busy at work. If I was not traveling on a given Saturday, I was certainly in the office from dawn to dusk. I had a small TV on which I occasionally watched football, but I don’t think that I ever watched a Michigan game. I did not even check the scores until I was sure that the game was over. I told people that my favorite weekend was U-M’s bye week.

The 1997 team featured perhaps the greatest defensive back of all time, Charles Woodson, who had been a freshman phenom in 1995 and a consensus All-American in 1996. He was also used—to great effect—as a kick returner and wide receiver. The team won all of its games, but in The Game it needed a tremendous effort from the defense and special teams to overcome a moribund offense. It faced a very good Washington State team in the Rose Bowl.

I watched the game with my friend Tom Corcoran. Woodson was Superman without the cape, but the rest of the team struggled. With a 21-16 lead U-M had the ball with 7:25 to play. Michigan got two first downs passing (once to Woodson) before Wazoo took over on its own seven yard line with sixteen seconds to play. After a hook and lateral play and the most egregious example of offensive pass interference that I have ever seen WSU moved the ball to the Michigan twenty-six. The clock ran out as the WSU quarterback tried to spike the ball. They should have had a play ready to run. I remember telling Tom that I could not believe that this was what I was hoping for. I never wanted to go through anything so nerve-wracking again.

So, U-M was named national champion by the Associated Press, but the coaches voted for Nebraska, which was also undefeated.

The next three years were bizarre. Michigan turned into “quarterback U”. Tom Brady24 and Drew Henson25 battled for the starting job for two years. Brady eventually prevailed. Henson started for U-M in his junior year, which was typified by a 54-51 loss to Northwestern that must have made Bo rip his hair out (if he had any left). Nevertheless, those three teams won bowl games over Arkansas, Alabama, and Auburn.

The last seven years of Carr’s coaching career were drearily predictable. There were only two quarterbacks. U-M beat OSU in 2004, John Navarrre’s senior year. Henne lost four times in The Game. They were all good teams, but …

I watched onlyone game. I was visiting my dad in Overland Park, KS, the weekend in 2004 when U-M played San Diego State (coached by Brady Hoke) in Ann Arbor. U-M, which had lost to Notre Dame the previous week, were behind at the half. The on-the-field female correspondent stuck a microphone in Coach Carr’s face and asked him what he expected in the second half. He said, “I expect a comeback.” U-M did win, but it was really ugly.

The worst and best games were in the last year, 2007. The loss to Appalachian State in Ann Arbor was, at the time, the low point of Michigan Football in my lifetime. The victory over Florida (coached by Urban Meyer and led by Tim Tebow) in the Capital One Bowl was a pleasant surprise. U-M had four turnovers, but Henne passed for 373 yards and was named MVP.

Coach Carr was living in Ann Arbor in 2024.

Rich Rodriguez and Brady Hoke 2008-2014: I felt strongly that after Carr retired U-M should have hired Jim Harbaugh. After a long career as a quarterback in the NFL he had coached the Raiders’ quarterbacks for two years and then transformed a horrible University of San Diego team into conference champions in only two years. Stanford hired him in 2007, but I suspected that he would have accepted any reasonable offer from U-M. Instead someone decided to pay West Virginia University $2.5 million to allow its coach, Rich Rodriguez, to forsake the Mountaineers and come to Ann Arbor.

I saw two of the games of the Richrod/Hoke era in person. Sue and I were in Ann Arbor in 2008 for the team’s home debut against Miami University. It was a horrendous game. I suspected that Miami would have won if its quarterback had not been injured.

It took a couple of years, but Rodriguez was able to field a pretty good offense built around Denard Robinson. The big problem was on defense. Richrod hired Greg Robinson to coach the defense, and the results were absolutely pathetic. U-M fans were not accustomed to teams running up the score on them, but it became commonplace.

The other game that I viewed in person was in Hoke’s regime, but it was also horrendous. It was a night game played at Rentschler Field in East Hartford in 2013. More than half the fans were wearing Michigan’s colors. It was very close up to the end. Michigan ended up with a 21-14 victory.

That game increased my appreciation of the alcohol-free atmosphere of Michigan Stadium. Some UConn fans were really obnoxious. However, the team’s play did not impress me at all.

Michigan somehow beat OSU in Brady Hoke’s first appearance in 2011. That team also defeated Virginia Tech 23-20 in the Orange Bowl. However, it was downhill from there. The 2014 team’s record was 5-7, which caused Hoke to be fired. The Athletic Director who had hired him, Dave Brandon, resigned.

Jim Harbaugh pre-Pandemic 2015-19: My career as a cowboy coder had just ended when Jim Harbaugh’s stint as U-M’s head coach began. He brought “an enthusiasm unknown to mankind” and a basket of new ideas. He took all of the players to Rome as part of Spring practice. He conducted coaching clinics in the southeastern U.S. These radical approaches to the job and the fact that he almost always spoke his mind engendered a lot of enmity against him in the community of coaches.

The 2015 team was much improved. After losing to Utah on the road to open the season the Wolverines won nine of the next ten games. The only blemish was a loss to MSU in Ann Arbor that was reminiscent of Keystone Kops, On the last play of the game the snap to the punter went astray leading to a 27-23 victory for Sparty. In The Game at the end of the season the team was clobbered by OSU, but the Wolverines delivered an even worse thrashing to the Florida Gators in the Capital One Bowl.

The next four years were more of the same—one or two stumbles early, lots of very promising victories, and a blowout loss in The Game. In these years, however, the bowl games were also losses. Fans were becoming upset with Harbaugh, but those OSU teams were extremely good. Their teams were loaded with five-star recruits, and U-M’s quarterback always seemed to get hurt near the end of the season.

MGoBlog and BPONE: MGoBlog was founded by Brian Cook in 2004. I must have discovered the website that covered all of Michigan’s sports shortly after that because I am pretty sure that my dad told me that he was impressed by how much I knew about the U-M football team even before he moved to Enfield in 2005. The emphasis of the blogs was on football, of course. The most amazing aspect was that someone (Brian at first, later Seth Fisher) charted and analyzed every play of every U-M football game.

Brian and Seth also appear on the Michigan Insider radio show that was hosted weekly by Sam Webb on WTKA and was streamed on MGoBlog.com. Craig Ross, a lawyer who was born a year or two before I was, also appeared on the show. Ross was a super-fan of all of the U-M sports.

I have spent an inordinate number of happy hours reading and listening to these guys and the other members of the MGoBlog crew. I especially appreciated the analysis of the strengths and weaknesses of U-M’s opponents that was provided by Alex Drain.

Brian, who was a very talented writer, often bared his soul about sports and his personal life. He invented the acronym BPONE, which stood for Bottomless Pit of Negative Expectations. It described a state of mind when one can no longer appreciate the positive aspects of viewing sports because he/she (hardly ever she) is convinced that they will be overwhelmed by negative aspect in the end. BPONE is precisely the reason that I gave up watching the Wolverines on television. Once you have seen Colorado’s “Miracle at Michigan” or the bungled punt attempts against MSU and Appy State it was difficult to keep them out of your mind.

Harbaugh’s glory years 2021-23: I should pass over without mentioning the monumentally stupid college football season of 2020. U-M won two of the six games in which it was able to field a team of players who did not have Covid-19. I blame Trump, who insisted that all the teams should play during the second wave of the most infectious disease anyone had seen.

In preparation for the 2021 season Harbaugh had dramatically reshuffled his assistant coaches. The primary goals were to design offenses and defenses that would be effective against the ones used by Ohio State. The players recruited for these new schemes were big, tough, and smart. Harbaugh promised that he would beat Ohio State or die trying.

Expectations for the 2021 season were not high in Ann Arbor, but there were some scraps of good news. Aidan Hutchinson30, the All-American defensive end, returned. Cade McNamara and five-star freshman J.J. McCarthy seemed promising as quarterbacks.

In fact, this was a very good team. It lost a heart-breaker to MSU in the middle of the season when Kenneth Walker III ran for 197 yards and five touchdowns, but the Wolverines still entered the Ohio State game with a surprising 10-1 record. The team played an inspired game and defeated the Buckeyes by a score of 42-27. They then annihilated Iowa in the conference championship 42-3. They were ceded #3 in U-M’s first appearance in the College Football Playoff. The team was outclassed by eventual champion, Georgia, 34-11. Nevertheless, this was was the most accomplished Michigan team since the 1997-98 team that was named national champion by the AP.

Even Brian Cook was optimistic about the 2022 team. Hutchinson was gone, but this team had two legitimate quarterbacks, two outstanding running backs, Blake Corum and Donovan Edwards, outstanding receivers, and the best offensive line in the country. The questions were on defense were quickly answered. The team breezed through its first ten games. A stubborn Illinois defense nearly engineered an upset in Ann Arbor, but the team was still undefeated and ranked #3 for The The Wolverines prevailed in Columbus for the first time since 2000 by a score of 45-23. They then sleepwalked past Purdue in the Big Ten championship and entered the CFP ceded #2.

Their opponent in the semifinal was Texas Christian. Michigan was favored by almost everyone, but J.J. McCarthy had a terrible game, and Blake Corum had been severely injured late in the season. The defense also had trouble stopping TCU’s attack; it did not help that two or McCarthy’s early passes were intercepted and returned for touchdowns. In the end the Horned Frogs won 51-45. Perhaps it was just as well that U-M lost that game. Georgia overwhelmed TCU in the final.

The 2023 team had one goal: to win the national championship. Almost all of the important players and coaching staff returned. The team was ranked #2 behind Georgia for nearly the entire season in both polls.

Two silly “scandals” were distractions. Because of allegations of recruiting violations in the Covid-19 year31 Harbaugh did not attend the first three games, which were blowouts of non-conference teams. Because of bizarre behavior of a low-level analyst with the unlikely name of Connor Stalions. He apparently bought tickets for people for games of prospective U-M opponents. Some of them allegedly took videos of the signs used to signal plays32 to the field. The Big Ten’s investigation resulted in the firing of one coach and the requirement that Harbaugh not be on the field for the team’s last three regular season games.

Those three very important games—were overseen by the Offensive Coordinator, Sherrone Moore. The results were decisive victories over Penn State, Maryland, and Ohio State. Michigan then shut out Iowa in the last conference championship game ever. After Seth Fisher analyzed each play of U-M’s semifinal overtime triumph over Alabama in the Rose Bowl he called it the greatest of Michigan’s 1,004 victories. The victory over Washington in the final game was less dramatic but equally satisfying.

In the end Michigan was the unanimous choice as #1, and the NCAA said that they had won the title fairly.

Denouement: Nick Saban, the long-time extremely successful coach at Alabama retired. Harbaugh resigned after agreeing to become the head coach for the Chargers, one of his old teams. Sherrone Moore was named U-M’s head coach. McCarthy, Corum, and quite a few others went pro. Some of the coaches accompanied Harbaugh to wherever the Chargers play these days.

In February of 2024 I watched the entire Rose Bowl game v. Alabama. I could not have watched it live. There were too many times in which Michigan committed unbelievable blunders that threatened to blow the game open. The FIRST PLAY was an interception that was overruled! BPONE would have overcome me. At least one vital organ would have failed.

How will Michigan do in the future? I sincerely doubt that the heroics of team #144 will ever be matched by any Michigan team in the future. College football has changed so drastically in the early twenties, and most of those changes do not bode well for the Wolverines.

I am quite happy that I got to experience this event even though I refused to make the kind of emotional investment in the team that others did. Their reward was no doubt greater.

1. Len Dawson, a Purdue graduate, led the Chiefs to victory in Super Bowl IV. He died in 2022.

2. Curtis McClinton, who went to the University of Kansas, was the AFL’s Rookie of the Year in 1962. He played nine years for the Chiefs. He was still alive and living in KC in 2024.

3. Fred Arbanas was a graduate of Michigan State. In January of 1965 he was assaulted in KC and lost vision in one eye. He nevertheless was an All-Star for the Chiefs for several years after that. He died in 2021.

4. The only one that I missed was one of the greatest U-M games of all time, the 1969 Ohio State game. I opted to attend a debate tournament in Chicago instead. This was one of the poorest choices that I ever made. I even gave away my ticket, which was on the 50-yard line halfway up.

5. I never heard anyone call him “Billy” in the year that he lived in A-R. He was generally known as BT, just as Darden was commonly called TD.

6. This game was attended by my parents while I watched on TV in Leawood! I was on my holiday break from classes.

7. Michigan easily won all ten games before the OSU game. The combined scores of it first three home games was 140-0.

8. Dennis Franklin had a cup of coffee with the New York Lions. He lived in Santa Monica, CA, in 2024.

9. Mike Lantry was my age. If he had gone to U-M after high school, he would have played when I was an undergrad. Instead he went to Vietnam. Although he held many records for kicking when he graduated, and he was a first team All-American, he is best remembered for three crucial kicks that he missed in the 1973 and 1974 OSU games. In 2024 he was living in Florida.

10. Rick Leach was still alive in 2024. His professional career was as a baseball player, mostly riding the pine with the Detroit Tigers.

11. Harlan Huckleby played six years for the Green Bay Packers. He was still alive in 2024.

12. Charles White played for the Cleveland Browns and the Los Angeles Rams. He led the NFL in rushing in 1987. He died in 2023.

13. Jim Brandstatter was in the same class as TD and BT. He tried out for the NFL but never played. He had a very long career in broadcasting. He was still alive in 2024.

14. Anthony Carter’s official height was 5’11”, and his weight was 168 lbs. I was two inches taller and 23 lbs. lighter when I entered the army. So, I was much skinnier than Carter. However, compared to nearly all football players, Carter was a midget. He set an incredible number of records. You can find them on his Wikipedia page, which is posted here. Carter was still alive in 2024.

15. Butch Woolfolk was a track star as well as one of the all-time great running backs at U-M. He also had an outstanding professional career. He was still alive in 2024.

16. John Wangler had to fight for the quarterback job his entire career at U-M, and he did not make the grade in the NFL. Nevertheless he will always be remembered for that pass in the Indiana game and his victories in The Game and the Rose Bowl. He was still alive in 2024.

16. Steve Smith started at quarterback for U-M for three years. He played for a couple of years in Canada. He was still alive in 2024.

17. Jack Harbaugh was the head coach at Western Michigan and then Western Kentucky, where his team won the Division I-AA national championship in 2002. The most important aspect of his career at U-M was probably the introduction of his son Jim to the nicest football town and best program in the country. Jim hired him as an assistant coach in 2023 (at the age of 84), and he was on the sideline coaching away when the Wolverines finally won it all in 2024.

18. Cris Carter was a phenomenal receiver, perhaps the best ever, but he had difficulty staying out of trouble. He was suspended for his senior year (1988) at OSU and then had a long and checkered NFL career. The high spots were lofty enough to get him into the Hall of Fame. Since his retirement after the 2002 season he has had had a few jobs in sports broadcasting.

19. Elvis Grbac had a reasonably successful, at least in financial terms, eight-year career in the NFL. He retired to become athletic director of his old high school in Cleveland. Believe it or not, he had a brother named Englebert.

20. Desmond Howard, who went to the same high school as Grbac, had a very successful NFL career and an even more successful career as an analyst at ESPN. I sat next to him on an airplane once during the early days of his career there.

21. I was astounded to learn that in 2023 Tyrone Wheatley had been hired as the head football coach at Wayne State in Detroit. He had a long and successful NFL career with the Giants and Raiders.

22. Todd Collins was never a big star at U-M, but his NFL career, which started in 1995 lasted until 2010, although on two different occasions he took a few years off. He was never a starter, but he evidently was widely considered a reliable backup.

23. Charles Woodson was just as good in the NFL as he had been in college. He played from 1998 to 2015, an astonishingly long career for a defensive back. The greatest interception of all time can be viewed here. In 2024 Woodson worked as an analyst for Fox.

24. Tom Brady became the greatest quarterback of all time in the NFL.

25. Drew Henson dropped out of school after his junior season and signed a contract with the New York Yankees. He bounced around in the minors before and played only eight games with the Yankees before retiring in 2004. He then tried the NFL, where he saw very limited action over a five year career. He was still alive in 2024, apparently working for a company that advised players on economic matters.

26. John Navarre was drafted by the NFL, but he played in only two games. In 2024 he lived in Elmhurst, IL.

27. Chad Henne played fifteen years in the NFL, mostly as a backup quarterback. His last few years were with the Chiefs. He retired in 2023.

28. This is my favorite figure of speech. It is called preterition.

29. Thankfully Walker played only one season for MSU. He was drafted by the Seahawks.

30. In 2024 Aidan Hutchinson was the cornerstone of the rebuilt Detroit Lions.

31. Brian Cook and the other MGoBloggers call this incident “hamburgergate”.

32. I was shocked to learn that it was illegal to go to other teams’ games to scout. I also assumed that everyone tried to “steal” signals and that teams took measures to make this nearly impossible. The NFL has installed technology that allows the coaches to talk to the players on the field. College coaches refuse to consider this arrangement.